Open wechat

Open wechatAfter the dust collection of dental implants was settled, another "wealth code" orthodontics in the field of stomatology also fell into the net, and the most important thing is that invisible orthodontics is also included in it, and the scope is tentatively 15 provinces/regions.

Among the "three major items" (implant, orthodontics and whitening) of dental consumer medical care, only whitening "survived". From the perspective of the overall dental patient market in China, the largest size of implants (accounting for 40%) and the second largest size of orthodontics (accounting for 30%) may be the underlying logic of centralized procurement.

Recently, the Shaanxi Provincial Public Resources Trading Center issued the Announcement on Centralized Procurement of Orthodontic Brackets by the Inter-Provincial Alliance (Region, Corps) (hereinafter referred to as the "Announcement"), which said that it decided to purchase orthodontic brackets in Shaanxi, Shanxi, Inner Mongolia, Liaoning, Heilongjiang, Anhui, Henan, Guangxi, Hainan, Guizhou, Tibet, Gansu, Qinghai, Ningxia Xinjiang and other 15 provinces (autonomous regions, production and construction corps) have carried out centralized and mass procurement of orthodontic brackets.

According to the policy, the centralized purchase category involves brackets, non-bracket invisible braces, and buccal tubes; Medical institutions involved include public medical institutions (including military hospitals) that carry out orthodontics in the region (all should participate), and social medical institutions designated by medical insurance (voluntary participation). The implementation of centralized purchase has undoubtedly brought significant variables to the orthodontic market, but whether it is good or bad depends on the multidimensional perspective.

There are many differences from "dental implant" collection

In the past two years, the news and progress of dental implant collection has aroused strong concern in the industry, and the market was once shrouded in panic.

Just two months ago, the collection of dental implants was also difficult to land. During the centralized procurement of dental implants, it is clear that the centralized procurement of dental implants and the auction of dental crowns will be put on the network, and the price of dental implant medical services will be regulated. Among them, the full-process regulation target of the medical service price in the tertiary public hospitals is 4500 yuan per tooth (the secondary and primary hospitals can float 10% - 20% up and down on the tertiary standard).

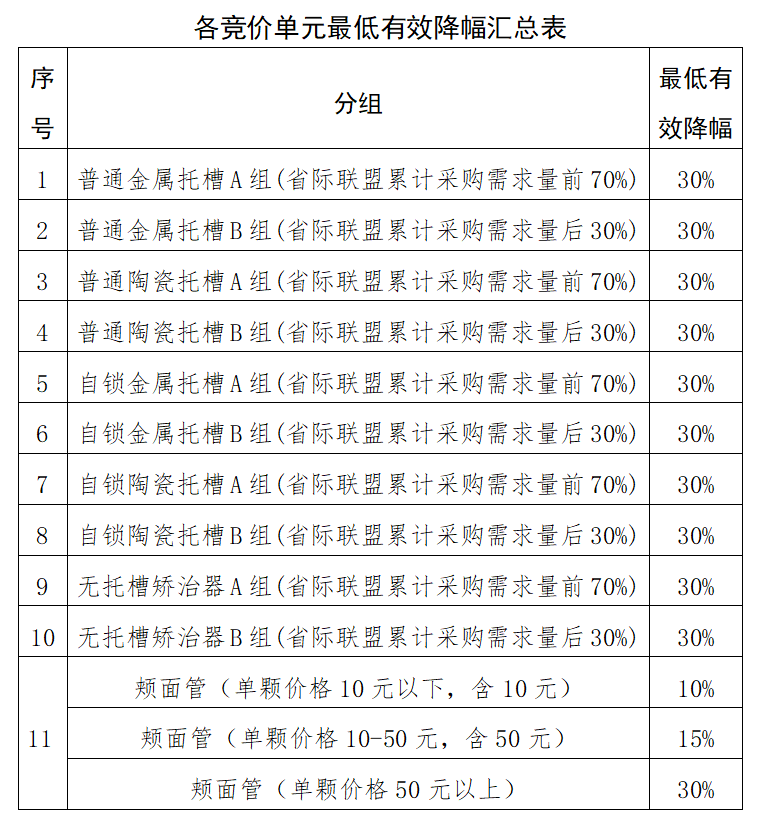

Compared with the centralized purchase of dental implants, the control of the centralized purchase of orthodontics is "slightly mild": in addition to the price limit of service fees, the minimum effective cost reduction is set at 30% in the price limit of consumables, which is equivalent to a 70% discount to win the bid; And it is not clear whether non-medical insurance designated private medical institutions can participate.

In the process of centralized dental implantation, the charge management of dental implant medical service has triggered the change of the original industry pattern; In addition, the procurement method of dental implant consumables is packaging procurement - procurement is carried out according to the implant product system consisting of one implant, one abutment and one accessory package. The centralized purchase of orthodontic brackets is based on the classification of orthodontic methods and materials, which is specifically shown in the grouping of this round of centralized purchase (as follows).

From the official website of Shaanxi Provincial Public Resources Trading Center

Why is there such a difference? This is related to the cost composition of dental implants and orthodontics and the attribute of medical needs.

First of all, these two services include product costs+medical service costs, in which the cost of implant products (abutment/implant+crown+restorative materials) accounts for more than 75%, and the cost of medical services (surgery+anesthesia) accounts for about 25%; In contrast, the "curative effect" of orthodontics is closely related to the difficulty of orthodontics, treatment technology (products), and the services of doctors. The product cost often accounts for less than 30% of the total cost. Secondly, the medical properties of dental implants are stronger and belong to rigid needs. Only by comprehensively reducing the price can we better meet the public demand.

It is understood that the difficulty coefficient of orthodontic diagnosis and treatment is the largest among dentists, and the success of treatment depends largely on the level and aesthetics of orthodontists. It is reported that the terminal price of orthodontics is mainly concentrated on the income of medical services. The price of a good set of metal orthodontic brackets sold to the hospital is about 2000-3000, while the final cost of consumers is more than 20000 yuan, which reflects the service value of doctors.

It is also because of the "superiority" of technology that orthodontics may not be suitable to control the price of medical services like dental implants at the current stage, otherwise it may affect the enthusiasm of orthodontists and affect the development of the industry.

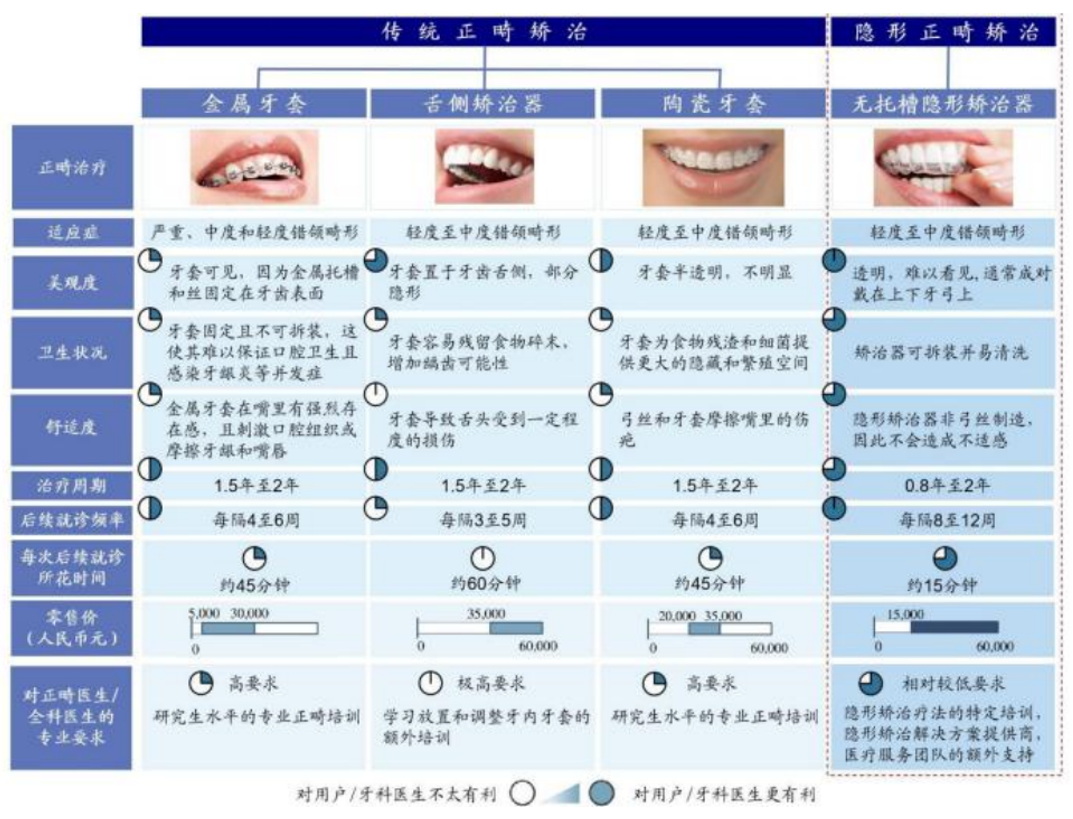

At present, there are mainly traditional orthodontics and invisible orthodontics. In traditional orthodontics, metal braces are usually used in one step until the treatment is completed; However, patients who use invisible orthodontics generally need to replace a new pair of appliances after wearing them for a period of time, and repeat the process until the treatment is completed. Invisible orthodontics is different from fixed orthodontics in biomechanics, material science, individual tooth movement, patient compliance and other aspects. Even professional orthodontists need to constantly learn new theoretical knowledge when using invisible braces for orthodontics.

Traditional orthodontics vs invisible orthodontics

According to Zhu Xianchun, director of the Orthodontics Department of the Stomatological Hospital of Jilin University and member of the Chinese Orthodontics Professional Committee, said in an interview with Arterial Network, from the perspective of patients, the advantage of invisible braces is that they can be removed and worn at any time, which is more convenient to clean, and more beautiful and comfortable to wear, so it is easier for patients to choose invisible orthodontics; However, for doctors, although invisible orthodontics saves time beside the doctor's chair, the work of modifying the scheme behind the doctor has increased, and more time and energy need to be spent on the formulation and design of the scheme.

However, some experts said, "Now the technology progress is too fast, the work of doctors has been reduced a lot, and the manufacturer has its own team of doctors to design the plan. At present, many outpatient doctors take the patient's dental model and send it to the manufacturer for treatment." Because of the above advantages, invisible orthodontics is called the future of orthodontics industry, and about 70% of it is completed in private hospitals.

At the same time, orthodontics and implant also share the common problem of "no shortage of consumables, no shortage of dentists". It is reported that there is a serious shortage of dentists in China at present. Compared with the number of dentists per million people in developed countries, there are only 137 dentists in China, and only 11% of them have dental implant qualifications. According to previous reports of 36 krypton, even in Beijing, which has the largest number of dentists (405) per million people, patients have to queue up for 2-6 months to seek dental implants in some dental hospitals.

Similarly, the number of orthodontists in China is far from enough to cover the demand population. Taking the certification results of the Professional Committee of Orthodontics of the Chinese Stomatological Association as an example, as of November 2021, the number of orthodontists certified by the Committee was only 6041.

Because of the strong dependence on doctors, in terms of in-depth services and channels, dentists have almost mastered the "lifeline" of invisible orthodontics. Therefore, in order to compete for channels, invisible orthodontic enterprises can provide comprehensive services to clinics. The local promotion team will carefully divide the service areas, and one team will be responsible for one area. In some clinics with high sales, there will even be special staff stationed in the clinics to receive patients and promote products, and also provide outpatient training and technical guidance.

In addition, similar to dental implants, the premise of being included in the scope of centralized purchase is that there are enough manufacturers and there is room for degradation.

It is reported that in the world, traditional orthodontic manufacturers include not only multinational companies such as Ormeco, Mayo Orthodontics, Despersinold and 3M, but also local companies such as Pute Orthodontics, Sanby Orthodontics, West Lake, New Asia Orthodontics and Chinese Orthodontics. In the field of invisible orthodontics, there are also many brands. In addition to Aiqi Technology (the parent company of Yinshimei) and Time Angel, which share the majority of the market share (80%) equally, Ormec, Zhengya Technology, Zhengli Technology, Meiji, Tooth Collar Technology, etc. have also risen in the domestic market.

From the price point of view, searching the price of the mainstream transparent braces (bracketless appliances) in the current market can find that the price of the traditional bracket appliances ranges from 20000 to 20000 yuan, while the price of the domestic brand invisible braces ranges from 20000 to 50000 yuan, while the price of the imported brand is 40000 to 50000 yuan. The gross profit of invisible orthodontics is particularly high. According to the official announcement, from 2019 to 2021, the gross profit rate of Time Angel was 64.6%, 70.4% and 65% respectively; The gross profit margin of Yinshimei is 72%, 71% and 74% respectively. After being included in the scope of centralized purchase, the gross profit will be further compressed.

New variables in orthodontic industry

According to the data of Brilliance Consulting, the global orthodontic market was 59.4 billion US dollars in 2020, of which the Chinese orthodontic market increased from 3.4 billion US dollars in 2015 to 7.9 billion US dollars in 2020. In 2030, the size of China's orthodontic market will reach US $29.6 billion, and the size of the invisible orthodontic market will reach US $11.9 billion. In addition, according to the statistics of Guoyuan Securities Research Institute in 2021, there are a total of 125 existing registration certificates of invisible appliances, which are held by 104 companies respectively. This "thriving" market is welcoming more players.

In order to reflect the advantages of differentiation, several startups have emerged in recent years that directly face consumers, that is, directly provide corrective services to consumers beyond clinics. Its product logic is very simple. Since it cannot break through the channel restrictions of the oligarch, it can bypass the link of the dentist directly, and can also lower the sales price and compete for the market in terms of price. However, this grey operation, which is evaluated as "non compliant" by professional doctors, is not accepted by the mainstream market at present.

In addition, there is the layout idea of "digital orthodontics". It is reported that this is a broader world than invisible orthodontics. Digital orthodontics is to use digital technology to obtain comprehensive case information, and accurately analyze 3D models, soft tissues, X-ray films, CBCT and other contents from multiple angles on the platform, so that doctors can systematically consider orthodontic problems, and use digital technology to assist in the design of treatment plans.

When designing the plan, doctors will select the best orthodontic tools according to the diagnosis, including invisible appliances, mobile appliances, lingual appliances, and traditional bracket appliances. With the help of digital technology, the combination of "invisible orthodontics+traditional orthodontics" can also be adopted.

In addition, there are more focused orthodontics for children by the target audience, such as "Elmo". The characteristics of children are that their problems are more serious than those of adults, and their rigid needs are stronger. It is reported that at present, only 4% of children with malocclusion see doctors. If they miss the opportunity of early intervention and blocking at the age of 3-12 years, if they wait for treatment in adulthood, they will face a large number of tooth extraction, and if they are serious, they will undergo jaw correction surgery; Teeth of children and adolescents still have the potential for growth and development. As long as the cause of malocclusion is removed and a comprehensive treatment plan is formulated, the comprehensive benefits of patients will be significantly improved.

On the whole, the penetration rate of China's orthodontic industry is still at a low level, and the special governance activities, such as "centralized procurement", are expected to increase rapidly after being carried out. At the same time, it will further promote the business volume of orthodontic-related departments and meet the large number of hidden oral medical needs of patients; In addition, excellent dental medical service institutions in the future can also form new growth points by creating improved and differentiated demand pricing projects, and the industry will continue to improve for a long time.

According to the calculation of Ping An Securities Research Institute and referring to the foreign situation, it is conservatively estimated that the penetration rate between 5-19 years old and 20-34 years old is between 5% - 10% and 1.1% - 2%, so the potential market space of China's orthodontic market is between 122.4 billion and 239.5 billion yuan, and there is still 5-10 times of growth space. However, it cannot be ignored that with the further increase in the number of players on the track, the competition is becoming fierce, and the final test is still the medical technology and curative effect.

Finally, I hope everyone can get the perfect smile of "tooth like a shell"!